Payouts

You can send payouts to any individuals to their

Getting started

To start making payouts, sign an agreement with Smart Glocal, go through the KYC process with Smart Glocal, and complete the integration via this API.

Where to start?

Prices and preconditions

The prices for payouts are stated in your agreement with Smart Glocal. You can discuss them with your manager. The limits vary depending on the payout method (wallet or bank_account).

To start making payouts, make sure you topped up your prefunding balance with Smart Glocal.

You need to monitor (using the wallet/balance method) your prefunding balance independently to make sure it is enough to keep payouts working. Please keep in mind that a bank wire takes 1 to 3 business days.

If the total of the payouts you have ordered using this API exceeds your prefunding balance, Smart Glocal will not be able to complete them.

Payout refunds

Payouts are non-refundable.

A payout you sent to a bank account may be refunded if the recipient bank did not credit it to the recipient's account for some reason even if the payout’s success was confirmed. In this case, such refunds are processed manually on our side, and you will get a refund as soon as they are reconciled. There is no automatic notification about such refunds.

Card identifier

To enable this functionality, please contact your manager at Smart Glocal.

If you do not store bank card details on your side and you need to understand which card the user is using and whether users' cards overlap, you can use the card identifier feature.

If you have multiple projects (

X-PARTNER-PROJECT), a card identifier may be the same or different for each project. Please inform your manager at Smart Glocal which option you prefer.

A card identifier is unique and is generated based on the card number and its expiration date. Its value is passed in the card_id parameter.

A card identifier can not be used for making payments or for getting all linked cards.

A card identifier is not a replacement for a token — if you use a token, you will receive both.

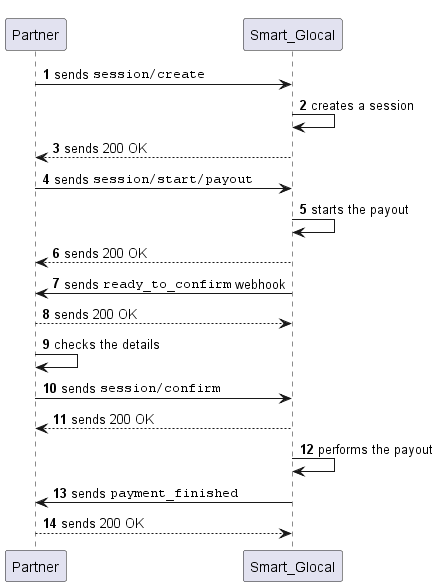

How to make a payout

All API operations are carried out within a payment session.

To create a payout, complete the following steps:

-

Create a payment session sending a

session/createrequest.Alternatively, you can use the

session/init/payoutmethod. In this case, specify all the payout parameters right away and skip the next step. -

Send a

session/start/payoutrequest to start the payout. -

Wait for a

ready_to_confirmwebhook. When you receive it, it means that Smart Glocal is ready to make the payout and is waiting for your confirmation. -

Send a

session/confirmrequest or asession/cancelrequest to confirm or cancel the operation. -

Wait for a

payment_finishedwebhook containing the result of the payout. If the status issucceeded, the payout was successful. To learn more about the payout statuses, see here.

Sequence diagram

How to specify the remittance purpose

The remittance purpose must be specified in bank_account.global.description within payment_method/payout_details as follows:

| Purpose | Description |

|---|---|

| COMPUTER_SERVICES | Computer service |

| FAMILY_SUPPORT | Family support |

| EDUCATION | Education |

| GIFT_AND_DONATION | Gift and other donations |

| MEDICAL_TREATMENT | Medical treatment |

| MAINTENANCE_EXPENSES | Maintenance or other expenses |

| TRAVEL | Travel |

| SMALL_VALUE_REMITTANCE | Small value remittance |

| LIBERALIZED_REMITTANCE | Liberalized remittance |

| CONSTRUCTION_EXPENSES | Construction expenses |

| HOTEL_ACCOMMODATION | Hotel accommodation |

| ADVERTISING_EXPENSES | Advertising and/or public relations related expenses |

| ADVISORY_FEES | Fees for advisory or consulting service |

| BUSINESS_INSURANCE | Business related insurance payment |

| INSURANCE_CLAIMS | Insurance claims payment |

| DELIVERY_FEES | Delivery fees |

| EXPORTED_GOODS | Payments for exported goods |

| SERVICE_CHARGES | Payment for services |

| LOAN_PAYMENT | Payment of loans |

| OFFICE_EXPENSES | Office expenses |

| PROPERTY_PURCHASE | Residential property purchase |

| PROPERTY_RENTAL | Property rental payment |

| ROYALTY_FEES | Royalty, trademark, patent and copyright fees |

| SHARES_INVESTMENT | Investment in shares |

| FUND_INVESTMENT | Fund investment |

| TAX_PAYMENT | Tax payment |

| TRANSPORTATION_FEES | Transportation fees |

| UTILITY_BILLS | Utility bills |

| PERSONAL_TRANSFER | Personal transfer |

| SALARY_PAYMENT | Payment of salary |

| REWARD_PAYMENT | Payment of rewards |

| INFLUENCER_PAYMENT | Payment of Influencer |

| OTHER_FEES | Broker, commitment, guarantee and other fees |

| OTHER | Other purposes |