Delayed capture payments

Delayed capture payments are widely used nowadays by all sorts of vendors as the delayed capture feature provides a number of benefits. For example, delayed capture payments allow you to:

- Prevent fraud by giving you enough time to verify a customer’s credentials before delivering a product or service.

- Charge customers after delivering them products or services.

- Reduce the number of chargebacks and refunds in case the transaction ends up canceled.

How it works

All payments consist of two key processes: authorization (when the bank verifies if the needed amount is available and places a hold on this amount) and capture (when the bank clears the payment and debits it).

In case of regular payments, these two processes happen almost at the same time and are not perceived by end users.

In case of delayed capture payments, however, you authorize the card, but wait to capture the funds. So, the funds are kept blocked on the user's card till your instruction to debit them.

How to enable delayed capture payments

If you would like to perform payments with delayed capture, please contact your Smart Glocal manager on the matter.

How long the hold period is

By default, the money is held for 5 days. If you do not debit or unblock it before the end of this period, the money will get unblocked automatically.

If you need the money to be debited rather than unblocked after the hold period end or the money to be held for a different period, please contact your manager.

How to make a delayed capture payment

Below you will find two ways of making a delayed capture payment.

- You are passing card details with open parameters

- You are using our payment widget

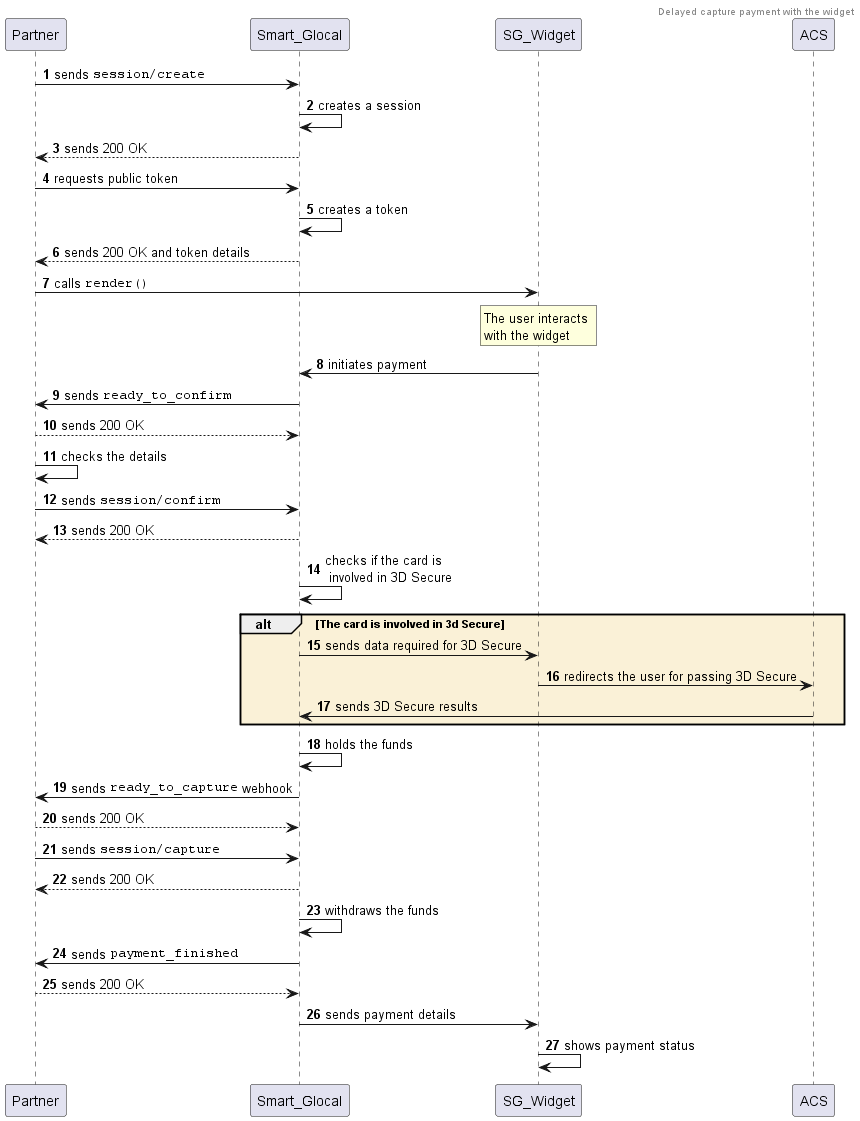

To create a delayed capture payment, complete the following steps:

-

Create a payment session sending a

session/createrequest.Alternatively, you can use the

session/init/paymentmethod. In this case, specify all the payment parameters right away and skip the next step. -

Send a

session/start/paymentrequest to start the payment. -

Wait for a

ready_to_confirmwebhook, which means that Smart Glocal is ready to perform the payment and is waiting for your confirmation. -

Send a

session/confirmrequest to confirm the operation or asession/cancelrequest to cancel the payment. -

If you receive an

action_requiredwebhook, it means that you need to take an additional action to perform the payment. For instance, the user might need to go through 3D Secure. Redirect the user for 3D Secure authentication using the link from the webhook. -

Wait for a

ready_to_capturewebhook from Smart Glocal. It means that a hold has been successfully placed on the amount. You can capture the amount immediately or later. -

When the time is ready, capture the amount put on hold (

session/capture) or decline the payment (session/cancel) unblocking the amount. -

Wait for a

payment_finishedwebhook containing the result of the payment. If the status issucceeded, the payment was successful.

Sequence diagram of delayed capture payments with open parameters

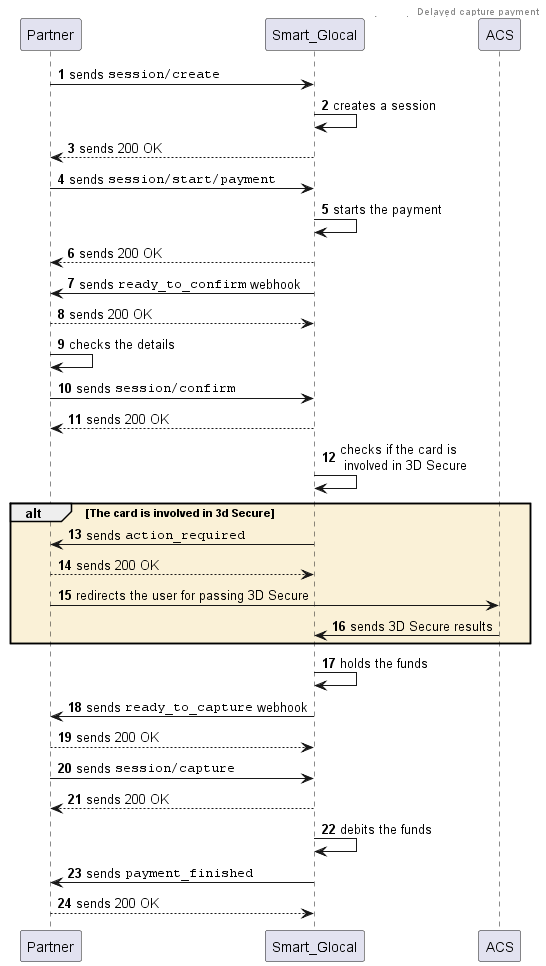

To create a delayed capture payment using our payment widget, complete the following steps:

-

Complete Steps 1–5.

If you receive an

action_requiredwebhook, send the HTTP 200 OK in response but do nothing, as the user will be redirected for 3D Secure within the widget. -

Wait for a

ready_to_confirmwebhook. When you received it, it means that Smart Glocal is ready to make the payment and is waiting for your confirmation. -

Confirm (

session/confirm) or cancel the payment (session/cancel). -

Wait for a

ready_to_capturewebhook from Smart Glocal. It means that a hold has been successfully placed on the amount. You can capture the amount immediately or later. -

When the time is ready, capture the amount put on hold (

session/capture) or decline the payment (session/cancel) unblocking the amount. -

Wait for a

payment_finishedwebhook containing the result of the payment. If the status issucceeded, the payment was successful.

Sequence diagram of delayed capture payments with the payment widget